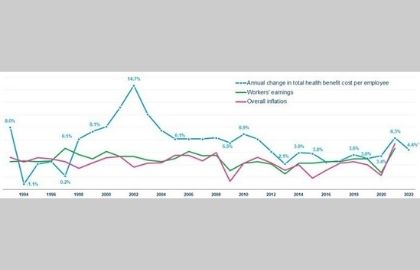

The average cost per employee cost of health insurance provided by the employer soared to 6.3 percent in 2021, as the employees and their families returned to treatment after avoiding it because of the pandemic, according to the HR consulting firm Mercer's 2021 national survey of Employer-sponsored Health Plans research published in December.

Employers are predicting on average a general average cost increase of 4.4 percent over the next year.

The responses came in 2021 from 1,745 employer health plan sponsors for employers across the U.S. with 50 or more employees.

Sources: Mercer; U.S. Bureau of Labor Statistics.

The biggest rise in health benefits costs surpassed wages and inflation throughout September, posing the issue of whether employers are seeing a temporary correction in the cost trend (following the prior year's rise by just 3.4 percent) or if it's the beginning of a new phase that will see higher cost growth.

"Employers are confident that this year's substantial increase is a direct result of people returning to care," said Mercer's chief actuary Sunit Patel. But he also warned that various causes could cause ongoing cost-growth.

"At the very top are higher utilization due to "catch-up" treatment as well as claims for prolonged COVID, very high-cost treatments for cellular and genetic diseases as well as the potential for inflation in health care," he said.

Cost increases were more pronounced for smaller businesses (50-499 employees) at 9.6 percent, whereas larger businesses reported average costs growth of 5 percent.

Smaller companies tend to provide fully insured health insurance plans, suggesting that insurance companies anticipate significant increases in cost in 2021 compared to 2020.

Source: Mercer.

Furthermore, the spending on prescription drugs increased 7.4 percent in 2021, mainly among large employers (those who have at least 500 employees), which was driven by an increase in the amount spent on specialty medications by 11.1 percent.

When health benefit costs increase, employers tend to ramp up their cost management efforts to ensure that the cost increases remain at sustainable levels. But one of the most common cost management techniques - cost-shifting - that allows employers to shift more of the costs of health care to plan members appears to be out of the question for many employers.

The issue of affordability of health insurance for low-wage workers, coupled with the necessity to keep and attract new employees in a competitive job market, has led to a sudden change in some cost-sharing patterns. The majority of employers did not hold back on increasing deductibles and other cost-sharing arrangements; however, some have also implemented modifications to decrease the cost of employees' out-of-pocket expenses for health-related services:

In small companies, the median deductible for individuals covered under PPOs dropped to $900 in 2021 from $1,000 in 2020.

In large companies, the median individual deductible under an HSA-eligible policy fell from $2,000 to $1,850 in 2021.

According to a study by the non-profit Kaiser Family Foundation (KFF), "half of U.S. adults report that they delayed or skipped dental or health care during the last year because of the expense, and 3 out of 10 report not taking their medication according to their prescription at some point during the last year because of the expense."

About half of those insured have difficulty paying for their out-of-pocket costs, and 1 out of 4 say they have difficulty affording their deductible.

The KFF Health Tracking Survey (Sept. 23-Oct. 4 2021) drew responses from 1,146 U.S. adults aged 18 or over.

"Cost-sharing helps constrain healthcare spending. But, when patients are subject to higher cost-sharing, they tend to spend less on both high value and low value care," according to researchers from Harvard Medical School and the University of Michigan's Institute for Healthcare Policy, writing in a post from December in the Health Affairs Forefront blog. They noted, "Thus, simply asking patients to pay more does not necessarily make them more effective shoppers for higher-value care," they noted. "Meanwhile, lower cost-sharing can analogously encourage consumption of both high- and low-value care."

Low-value care and overuse of healthcare contribute to the high and increasing costs of health care across the U.S.

The researchers said, "justifying cost-sharing as a tool in a variety of clinical scenarios. But, it's an unreliable instrument," they noted.

"There are common clinical scenarios--inappropriate procedures, tests or imaging, for example--where the financial incentives for providers to deliver the care could be constructively counterbalanced by lowering demand," the researchers explained. "Here costs-sharing can reduce costs and boost health. However, in situations where cost-sharing doesn't make sense such as the ones above it creates an obstacle that could cause danger for patients."

This website uses cookies to enhance website functionalities and improve your online experience. By browsing this website, you agree to the use of cookies as outlined in our privacy policy .